-

How to Get Pre-Approved Motorbike Finance – AAA Finance

A motorbike is more than just a way to get from A to B — it’s freedom, performance, and adrenaline on two wheels. Whether you’re chasing a brand-new model or a high-quality used bike, getting pre-approved motorbike finance through AAA Finance is the smartest way to save time, money, and stress. Why Get Pre-Approved Motorbike…

-

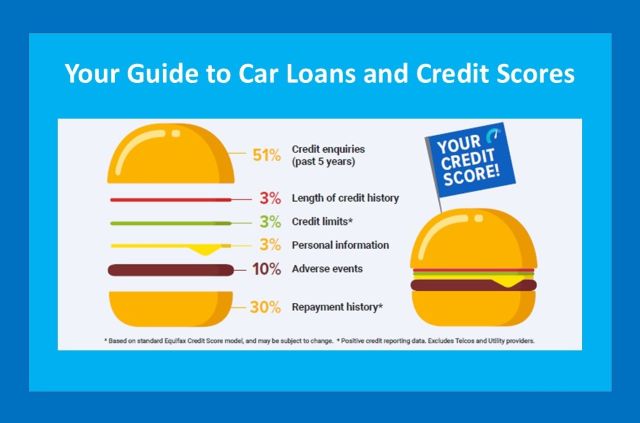

Car Loans and Credit Scores: What You Need to Know

Your credit score doesn’t just determine whether you can get a car loan. It also affects how much you can borrow and what interest rate you’ll be charged. A good credit score can make the process quick and stress-free. While a lower score may mean limited loan options or higher costs. Understanding how your credit…

-

Why You Should Buy a Five-Star Car

A five-star car isn’t just about luxury, speed, or the latest gadgets — it’s about safety. While many buyers focus on price, performance, fuel efficiency, and comfort, choosing a five-star safety rated vehicle puts safety first and builds protection into every drive. When buying a new car, safety should never be an afterthought — it…

-

EOFY Tax Benefits with Low Doc Finance: Time to Upgrade Your Vehicle or Equipment

EOFY is one of the best times of the year for business owners to invest in new assets—and Low Doc Car Loans make it easier than ever. If you’re thinking about upgrading your work vehicle or equipment, now’s the time to act. With streamlined documentation, fast approvals, and significant tax benefits available before June 30,…

-

EOFY Car Pre-Approved Finance

End of Financial Year is a golden window for buying a car—whether for business or personal use. But the smartest buyers don’t just shop for the best vehicle deals. They line up their finance first with EOFY Car Pre-Approved Finance. Pre-Approved Finance + EOFY Car Sales = Smart Buying Pre-approved finance gives you the upper…

-

Managing a Low Doc Car Loan

Low documentation (low doc) car loans are an attractive option for business owners and self-employed individuals who have an ABN. One of the main benefits of low doc car loans is that traditional financial documentation is not required by lenders. Managing a low doc car loan effectively is essential to ensure a stable business financial future. Strategies for…

-

Is Paying Off Your Business Car Loan Early the right Move?

Paying off your business car loan early might seem like a prudent financial decision. However, in many cases, it doesn’t offer the financial benefits you might expect. Here are 3 key reasons why. 3 Reasons NOT to pay off your business car loan early 1. Tax Benefits of a Business Car Loan The first key…

-

Should You Finance a Car for Business? How Buying on an ABN Can Save You Money

Many business owners wonder whether financing a car under their business is a smart financial move. The right financing choice can help you maximize tax savings, improve cash flow, and even unlock GST benefits. If you’re an ABN holder, purchasing a vehicle through your business can offer significant advantages—but it’s essential to understand the best…

-

Three Exciting Ways to Use a Personal Loan

Personal loans are often associated with financial responsibilities, such as debt consolidation or emergency expenses. However, they can also be a source of joy and fulfilment. In this article, we’ll explore three fun and creative ideas on how to spend your personal loan funds. These ideas can help you enhance your life and create memorable…

-

Financial Pitfalls to Avoid When Getting a Car Loan

Buying a car is an exciting milestone, but securing the right loan is just as crucial as choosing the right vehicle. Car loan pitfalls to avoid, such as poorly structured terms, can lead to unnecessary financial strain, higher costs, and long-term regret. Here are key financial mistakes to watch out for when financing your next…