-

AAA Finance – Your Complete Financing Solution

At AAA Finance, we pride ourselves on being more than just a finance broker. We are your complete financing solution – here to support business owners, consumers, and wage earners with a wide range of tailored loan options. From vehicles and recreational toys to business equipment and personal loans, we’ve got you covered. Complete Financing

-

How To Apply for a Car Loan and Get the Most Bang for Your Buck!

Buying a car is exciting, but the finance side can feel confusing. With so many lenders, rates, and options, it’s hard to know where to start to apply for a car loan. That’s where a finance broker steps in — doing the heavy lifting for you and saving you time, money, and stress. This guide

-

How to Apply for a Low Doc Vehicle Loan

Running your own business or working as a contractor often comes with its challenges, such as proving income when it’s time to buy a new vehicle. That’s where low doc vehicle finance comes in. These loans are designed specifically for ABN holders and business owners who don’t always have the latest tax returns or full

-

Top 6 Things to Take on Your Cape York Adventure

At AAA Finance, we’re more than just numbers and loan approvals – we’re about helping our clients and team members live out their adventures. Many of our clients already know Brian, our friendly front-desk concierge who makes the finance process seamless and stress-free. Recently, Brian swapped the office for the open road, taking an Austrack

-

Is an Electric Vehicle the Right Choice for Your Business?

An Electric vehicle (EV) is no longer just a futuristic concept —it is now a practical and increasingly popular option for business fleets across Australia. But does an EV make sense for your company vehicle? Let’s explore the pros, cons, and key considerations when deciding whether to plug in and go electric. ⚡ Electric Vehicle

-

How to Get Pre-Approved Motorbike Finance

A motorbike is more than just a way to get from A to B — it’s freedom, performance, and adrenaline on two wheels. Whether you’re chasing a brand-new model, a Learner Approved Motorcycle or a high-quality used bike, getting pre-approved motorbike finance through AAA Finance is the smartest way to save time, money, and stress.

-

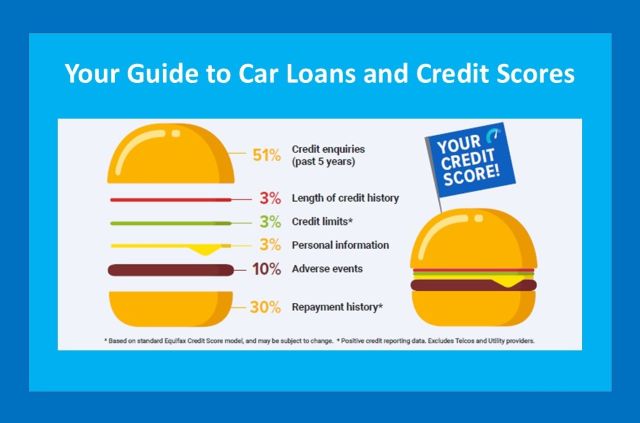

Car Loans and Credit Scores: What You Need to Know

Your credit score doesn’t just determine whether you can get a car loan. It also affects how much you can borrow and what interest rate you’ll be charged. A good credit score can make the process quick and stress-free. While a lower score may mean limited loan options or higher costs. Understanding how your credit

-

Why You Should Buy a Five-Star Car

A five-star car isn’t just about luxury, speed, or the latest gadgets — it’s about safety. While many buyers focus on price, performance, fuel efficiency, and comfort, choosing a five-star safety rated vehicle puts safety first and builds protection into every drive. When buying a new car, safety should never be an afterthought — it

-

EOFY Tax Benefits with Low Doc Finance: Time to Upgrade Your Vehicle or Equipment

EOFY is one of the best times of the year for business owners to invest in new assets—and Low Doc Car Loans make it easier than ever. If you’re thinking about upgrading your work vehicle or equipment, now’s the time to act. With streamlined documentation, fast approvals, and significant tax benefits available before June 30,

-

EOFY Car Pre-Approved Finance

End of Financial Year is a golden window for buying a car—whether for business or personal use. But the smartest buyers don’t just shop for the best vehicle deals. They line up their finance first with EOFY Car Pre-Approved Finance. Pre-Approved Finance + EOFY Car Sales = Smart Buying Pre-approved finance gives you the upper